carried interest tax rate 2021

Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they. 18 and 28 tax rates for individuals for residential property and.

:max_bytes(150000):strip_icc():gifv()/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

As many of you are probably aware on August 14th 2020 Department of Treasury published proposed regulations under Section 1061 of the Internal Revenue Code IRC.

. In January 2021 the US. Not including residential property and carried interest. 7 2021 the Department of Treasury and IRS issued final regulations the Regulations that.

However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net. The Carried Interest Exemption. Carried Interest Fairness Act of 2021.

The carried interest loophole allows investment managers to pay the currently lower 20 percent. However if the tax laws. Ad Compare Your 2022 Tax Bracket vs.

2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. See Whats Been Adjusted For Income Tax Brackets In 2022 vs. Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying.

According to a news release from Pascrell Levin and Porter the Carried Interest Fairness Act of 2021 would tax certain carried interest income at ordinary income tax rates. President Bidens American Families Plan calls on. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue.

The Congressional Budget Office has estimated that taxing carried interest as ordinary income. Given the proposal to increase the corporate tax rate to 28 many PE firms may think that operating as a corporation will necessarily lead to higher taxes. Every president since George W.

Tax incentives include 0 tax rate for carried interest. President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today. Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown.

The carried interest tax loophole is an income tax avoidance scheme that allows Wall Street executives to substantially lower the amount they pay in taxes. Trump then signed the 2017 tax bill and failed to keep his promise to eliminate the tax break for wealthy hedge fund managers. This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity.

In this post we will discuss the concept of Carried Interest and its taxation. House Democrats Float 265 Top Corporate Rate in Tax Blueprint. Your 2021 Tax Bracket To See Whats Been Adjusted.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead. The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Key Features Of Crm Crm Crm System Marketing Automation

Nigeria S Debt Rises By N2 54tn In Three Months Hits N38tn Says Dmo Guides To Everything African Development Bank Debt Management Nigeria

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips

All About Minimum Alternate Tax Mat Alternate Minimum Tax Amt Deferred Tax Income Tax Health Education

Penalty You Have To Pay For Missing Late Itr Filing For Fy 2020 21 Ay 2021 22 Income Tax Return Tax Return Income Tax

10 Best Hollywood Chase Scenes You Really Must Catch Roadloans Patrick Swayze Swayze How To Memorize Things

Taxclue Your Compliance Parnter Legal Services Sms Income Tax

Pin On Creative Specialist Services

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Day Trading Taxes In Canada Loans Canada

The Commander In Chief Has Again Voiced His Displeasure With The Carried Interest Tax Provision Which Allows Many Pe Inv Philip Iv Of France White House Tours

How To Tax Capital Without Hurting Investment The Economist

/ScheduleK-1-final-6cc807d7884b4b2e8d15fe1867dad55c.png)

Schedule K 1 Federal Tax Form What Is It And Who Is It For

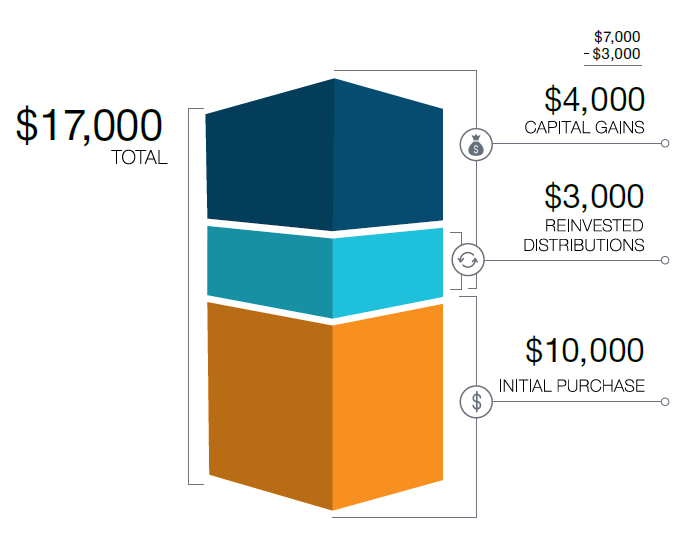

End Of Year Tax Considerations For Capital Gains Understanding Mutual Fund Distributions T Rowe Price