glenwood springs colorado sales tax rate

The US average is 28555 a year. Sales Tax Rates in Revenue Online.

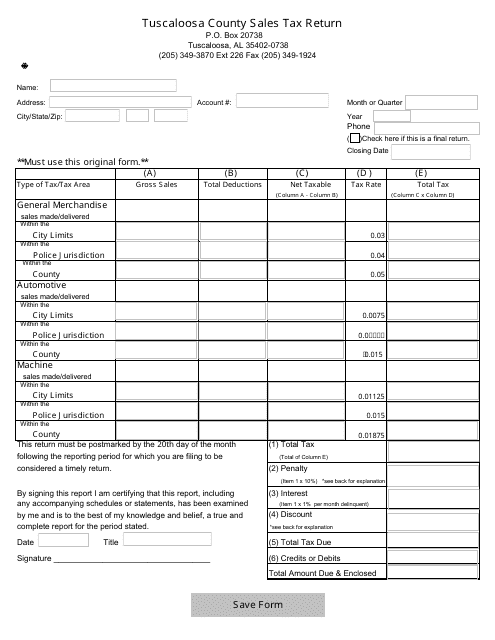

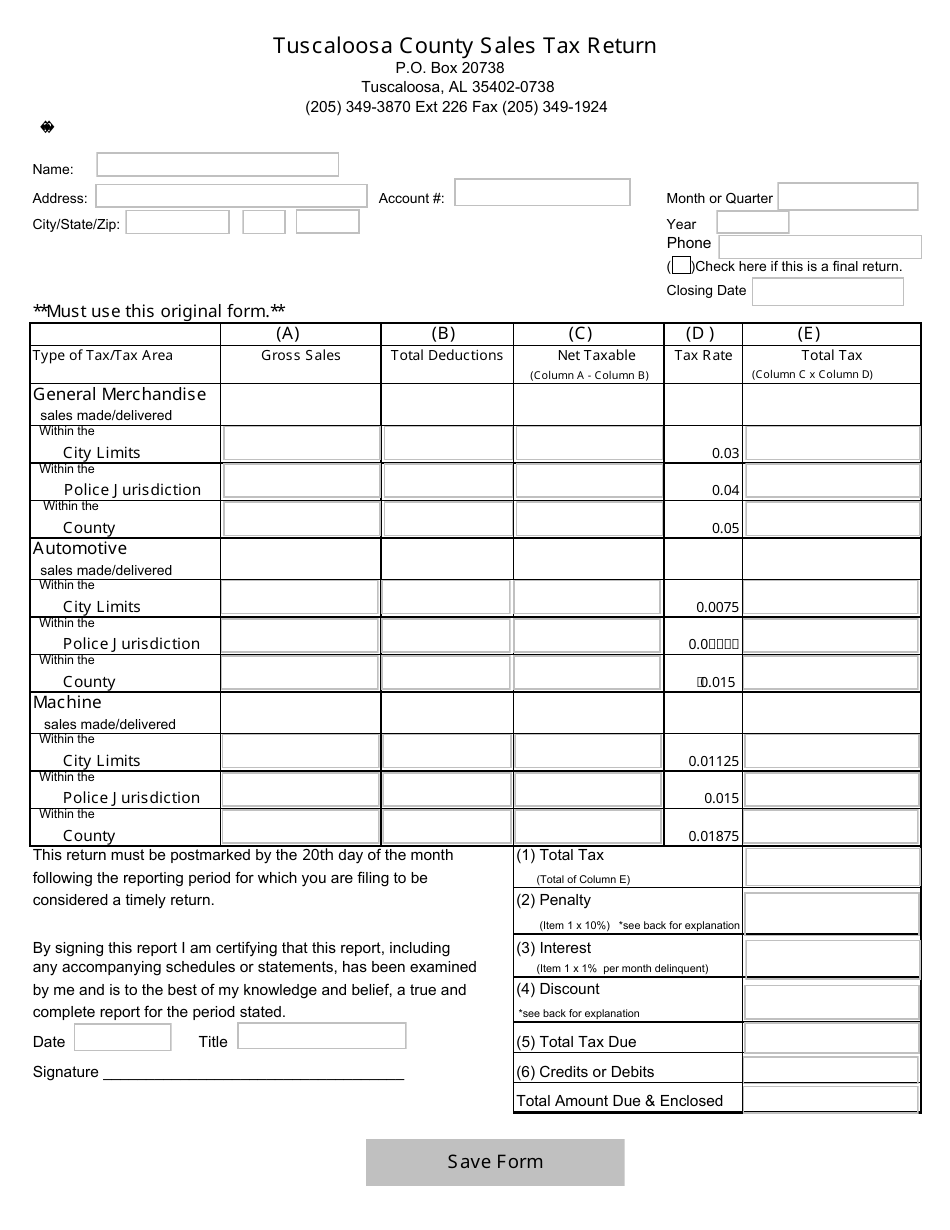

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

5 rows The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales.

. The City of Glendale is a Home Rule City and collects its own sales tax. The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with Net taxable sales greater than Exemptions County Municipality and Special District SalesUse Tax Exemptions Options. The Colorado sales tax rate is currently 29.

MUNIRevs allows you to manage your municipal taxes licensing 24x7. Sales Tax Rates in the City of Glenwood Springs. Two services are available in Revenue Online.

Average Sales Tax With Local. View Local Sales Tax Rates. For questions about sales tax please call 303-639-4706.

If you need assistance see the FAQ. 6 rows The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state. 1428 Darrow Aly Glenwood Springs CO 81601-7106 is a townhouse unit listed for-sale at 625000.

Sales and Use Tax Ordinance. Find both under Additional Services View Sales Rates and Taxes. What is the sales tax rate in Glenwood Springs Colorado.

Free Unlimited Searches Try Now. Glenwood Springs is located within Garfield County Colorado. - The Median household income of a Glenwood Springs resident is 54544 a year.

Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57. Address Phone Number and Fax Number for Garfield County Treasurers Office a Treasurer Tax Collector Office at 8th Street Glenwood Springs CO. Sales Tax Online Services.

The County sales tax rate is. 6 rows The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state. You can find more tax rates and allowances for Glenwood Springs and Colorado in.

Colorado has 560 cities counties and special districts that collect a local sales tax in addition to the Colorado state sales taxClick any locality for a full breakdown of local property taxes or visit our Colorado sales tax calculator to lookup local rates by zip code. The minimum combined 2022 sales tax rate for Glenwood Colorado is. The average cumulative sales tax rate in Glenwood Springs Colorado is 86.

Licensed retailers can find rate and jurisdiction code information for. Gleneagle CO Sales Tax Rate. Townhouse is a 3 bed 30 bath unit.

The Colorado sales tax rate is currently. One of a suite of free online calculators provided by the team at iCalculator. View more property details sales history and Zestimate data on Zillow.

This includes the sales tax rates on the state county city and special levels. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4075.

Find many great new used options and get the best deals for Glenwood Springs Colorado Postcard 1907 at the best online prices at eBay. The complete sales tax breakdown is as follows. - The average income of a Glenwood Springs resident is 28606 a year.

- Tax Rates can have a big impact when Comparing Cost of Living. 307 City of Colorado Springs self-collected 200 General Fund. Ad Get Colorado Tax Rate By Zip.

To begin please register or login below. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is 86. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8.

The Glenwood Springs sales tax rate is 37. Glenwood Springs CO Sales Tax Rate. 13 rows Sales Tax Rates in the City of Glenwood Springs.

This is the total of state county and city sales tax rates. Within Glenwood Springs there are around 2 zip codes with the most populous zip code being 81601. The US average is 46.

Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57. Sales Tax Rate Tax applies to subtotal shipping handling for these states only. Glenwood Springs CO Sales Tax Rate The current total local sales tax rate in Glenwood.

View Business Location Rates. Sales and Use Tax Ordinance Clarifications. If an exemption is not listed state-collected local jurisdictions do not have that exemption option.

Free shipping for many products. This is the total of state county and city sales tax rates. 375 City of Glendale 290 State of Colorado10 Cultural Tax25 Arapahoe County 100 RTD Tax 800 Total.

City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. This service provides tax rates for all Colorado cities and counties. The County sales tax rate is 1.

The sales tax rate does. The combined amount is 820 broken out as follows. Name Garfield County Treasurers Office Address 109 8th Street Glenwood Springs Colorado.

The Glenwood sales tax rate is. The Glenwood Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Glenwood Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Glenwood Springs Colorado. After receiving the item contact seller within.

If you need access to a database of all Colorado local sales tax rates visit the sales tax data page. Current City Sales Use Tax Rate. Income and Salaries for Glenwood Springs.

Illinois Sales Tax Rates By City

Colorado Sales Tax Rates By City County 2022

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Florida Sales Tax Rates By City County 2022

New Mexico Sales Tax Rates By City County 2022

Marijuana Sales Tax Department Of Revenue Taxation

New York Sales Tax Rates By City County 2022

Special Event Sales Tax Department Of Revenue Taxation

Colorado Property Tax Calculator Smartasset

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Sales Tax Filing Information Department Of Revenue Taxation

Sales Tax Guide Department Of Revenue Taxation

Washington Sales Tax Rates By City County 2022