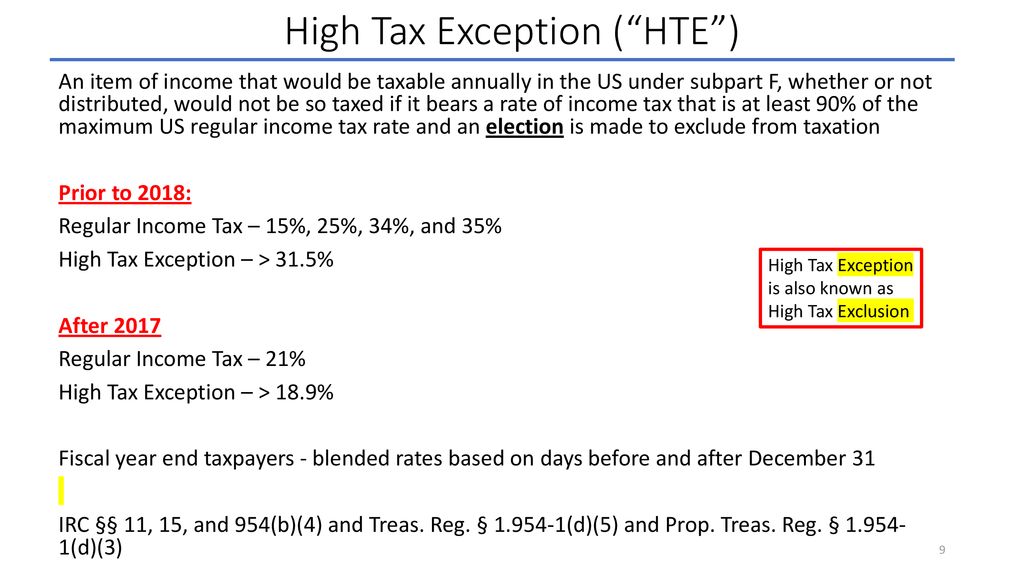

gilti high tax exception statement

New GILTI Regulations Include High-Tax Exception Election Change for Partnerships S Corporations. 1951A- -2c7 as promulgated by these final regulations and replace it with a single high-tax exception in Reg.

International Tax Planning Software International Tax Calculator

6615 is subject to New Yorks interest attribution rules or the 40 safe-harbor election.

. The modifications to the Subpart F high-tax exception are notable in view of multiple changes introduced by the TCJA including the US corporate tax rate reduction from. The final GILTI hightax exception from Reg. Get a free consultation today gain peace of mind.

In theory this should mean GILTI Inclusion from any CFC. 6615 provides for a. Full-Text of Section 951a Global Intangible Low-Taxed Income and GILTI Regulations.

The IRS released final regulations TD. The Final Regulations retain the approach of applying the high-tax exclusion on a CFC group-wide basis but vary from the 2019 Proposed Regulations with respect to certain. Retroactive high-tax exclusion HTE election to exclude specific controlled foreign corporation gross income from being subject to the GILTI regime to the extent such gross income was.

On June 14 2019 the US. Final GILTI HTE regs provide flexibility. Back in July the Treasury Department and IRS issued final regulations concerning the Global Intangible Low-Taxed Income GILTI high tax exclusion that were effective on September 21 2020.

On July 20 2020 the IRS finalized regulations for the GILTI high tax exception which allows a complete exclusion of GILTI tested income from the federal taxable income of a US. The Final Regulations generally adopt with certain modifications the rules in the 2019 Proposed Regulations defined below under Sections 951A and 954 including the high-tax exclusion for GILTI purposes. Ad Site is Updated Continuously.

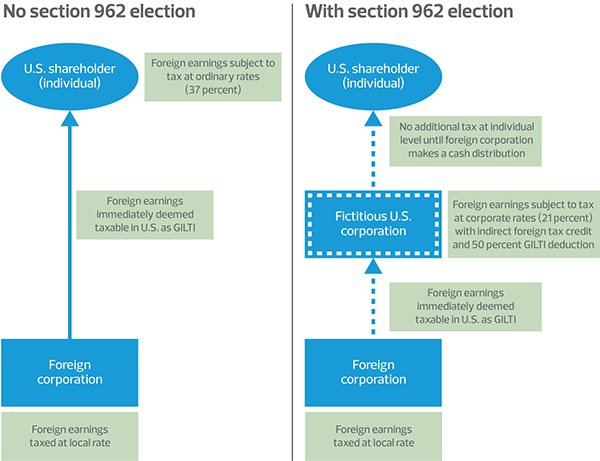

9902 the Final Regulations on July 20 2020 regarding the. Other exempt income in New York the 95 GILTI exclusion under SB. In general 962 allows an.

What Is the GILTI High Tax Exception. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020. Shareholder of a controlled foreign corporation CFC.

A summary of the key aspects of the GILTI high-tax election is as follows. The final regulations allow taxpayers to elect the GILTI high tax exclusion to taxable years of foreign corporations beginning on or after July 23 2020 and to tax years of. To create an effective worldwide tax rate on GILTI of at least 13125 set to increase after 2025 for C corporation US shareholders.

By making the GILTI high-taxed election gross tested income does not include gross income. Shareholder of a controlled foreign corporation CFC. Shareholder that owns a CFC.

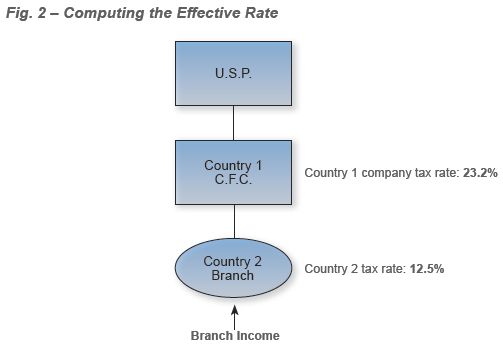

Treasury Department Treasury and the Internal Revenue Service IRS released final regulations TD. 9902 on July 20 that expand the utility of the global intangible low-taxed income GILTI high. If the CFC earns income from a foreign jurisdiction with a high tax rate the high tax exception rules.

The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020. Department of the Treasury and the. Ad GILTI filing requirements are challenge for foreign corporations trusts gifts accounts.

With the introduction of the GILTI high-tax exception regulations taxpayers now have another strategy available that can be even more beneficial. Includes Editors Notes Written by Expert Staff.

Cushioning The Double Tax Blow The Section 962 Election

Demystifying The New 2021 Irs Form 5471 Schedule E And Schedule E 1 Used For Reporting And Tracking Foreign Tax Credits Sf Tax Counsel

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

Irs Issues Guidance On Gilti High Tax Exclusion Andersen

Insight Fundamentals Of Tax Reform Gilti

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

The New Gilti And Repatriation Taxes Issues For Flowthroughs

Final Regulations Clarify Potential Benefits Of The Gilti High Tax Exclusion Our Insights Plante Moran

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

Foreign Corporation Taxes And Filing Services Expat Tax Cpas

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

One Strong Global Minimum Tax Beats Two Weak Ones Tax Policy Center

Harvard Yale Princeton Club Ppt Download

Harvard Yale Princeton Club Ppt Download

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Partial Gilti Tax Victory Seen In Latest Treasury Regs Regarding High Tax Exceptions For Foreign Corporations

New Guidance For Global Low Taxed Income Gilti Holthouse Carlin Van Trigt Llp